Loading...

Network is slow, please wait...

Manage your company's finances in one place. Zenind businesses are eligible to apply.

Get Started

Manage your company's finances in one place using Zenind Dashboard.

Receive payouts from popular eCommerce platforms and payment processors.

Transfer funds in or out between Zenind Finance Money Business Account and an external bank account.

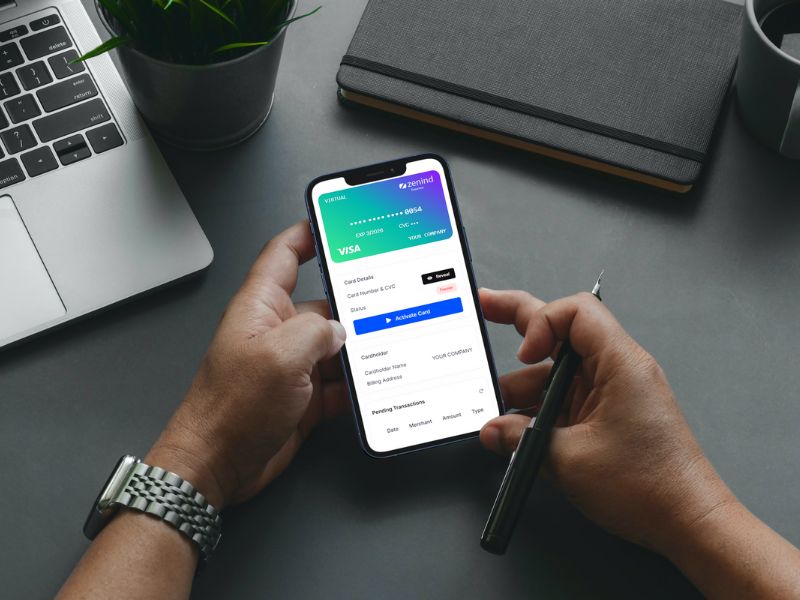

Use your Zenind Finance Money Visa® Card to make purchases wherever Visa® is accepted.

Your Zenind Finance Money Business Account is eligible for FDIC insurance up to $250,000.

Make purchases wherever Visa® is accepted with the available balance in your Zenind Finance Money Business Account. You can lock and unlock your cards from Zenind Dashboard to protect your account. Use a virtual card for online purchases and pay with peace of mind.

Take advantages of Zenind Finance Money Business Account and Zenind Finance Money Visa® Cards.

$10/month

(paid annually in advance)

$20/physical card

_

Zenind Inc. partners with Stripe Payments Company for money transmission and account services, with funds held at Goldman Sachs Bank USA, Member FDIC. Zenind Finance Money Visa® Commercial Credit cards are issued by Celtic Bank, Member FDIC.

¹ An inactive account fee will be charged to a Zenind Finance Money Business Account that has either experienced no payment transactions or has kept an average monthly deposit balance below $1,000 for a continuous period of 12 calendar months.

² Although Zenind does not charge you for ATM withdrawals, an ATM provider may charge you for withdrawals using a Zenind Finance Money Visa® Card.

³ A foreign transaction fee is imposed on transactions that are classified as cross-border transactions or necessitate the process of currency conversion.